5 Ways Lifestyle Spending Accounts (LSAs) Boost Employee Wellness

Posted: August 28, 2024

Employee wellness is an underrated way of elevating productivity and job satisfaction. Lifestyle Spending Accounts (LSAs) are employer-funded accounts designed to cover various wellness-related expenses, enhancing employee well-being. LSAs boost wellness by supporting fitness memberships, mental health services, healthy eating programs, work-life balance activities, and stress management resources. These accounts offer personalized benefits, empowering employees to choose wellness activities that suit their needs and improving...

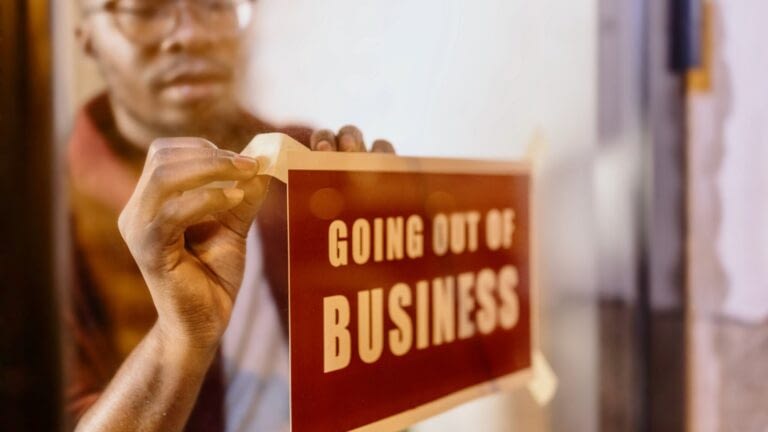

What happens to my 401(k) if my employer’s business shuts down?

Posted: August 13, 2024

A 401(k) is widely used to facilitate retirement savings, providing employees with a tax-advantaged way to build their nest egg. When an employer goes out of business, employees often worry about the security of their 401(k) funds. Fortunately, 401(k) plans are protected by federal laws and typically remain intact. Ownership of a 401(k) Account 401(k) accounts are owned by employees, not employers, ensuring the security...

Bolster Employee Resilience & Engagement with These 4 Tips

Posted: July 28, 2024

Unfortunately, dealing with health insurance and healthcare providers is one of the most challenging and stressful things an individual faces in today’s society. That is why healthcare benefits are a staple aspect of attracting and maintaining a talented workforce for a business. Yet, understanding and maximizing these benefits is often confusing for employees, leading to missed opportunities for care. Employers play a crucial role in...

How Can I Improve Healthcare Benefits To Better Serve My Employees?

Posted: July 13, 2024

Healthcare is among the most significant monthly expenses for individuals and families. One of the most common questions of potential employees exploring job opportunities involves healthcare benefits. Beyond attracting and retaining top talent, comprehensive healthcare coverage enhances employee well-being, productivity, and job satisfaction. It fosters employees’ sense of security and loyalty, leading to higher engagement and morale. Moreover, access to quality healthcare reduces absenteeism and...

5 Employee Benefits That Matter to Gen Z in 2024

Posted: June 28, 2024

“Generation Z” comprises people born between the mid-1990s and early 2010s. They are also commonly known as “Zoomers” because they needed to use remote conferencing tools like Zoom for school during the COVID-19 pandemic. Since the pandemic, they have been seeking stability, remote work options, and mental health support. Financial challenges, climate anxiety, and dependence on digital tools shape their priorities. To attract this generation,...